When we speak of climate or environmental debt today, we are most often referring to a “moral” and historical debt between countries. The historically more polluting countries in the Global North, which have benefitted economically in return, are considered debtors of the countries in the Global South, which contributed little to the climate crisis. While such an approach has its merits, and the question of how to distribute the cost of climate change between countries remains central, this report focuses on another approach to the concept of climate debt.

Rather than a retrospective debt between countries, climate debt can be seen as a loan from the future. With the Paris Agreement, we legally set ourselves the objective of keeping the rise in global temperature well below 2°C and continuing efforts to limit it to 1.5°C. At the EU level, we translated this treaty into binding emissions targets: -55% below 1990 levels by 2030 and net zero emissions by 2050. Any delay in meeting these commitments can be considered a liability or a loan. Emissions released today in excess of our target trajectory will have to be reduced in the future. Climate debt is therefore a biophysical debt (in tonnes of CO2 equivalents), which can even be translated into monetary terms and compared with other economic indicators.

The aim of this report is to highlight the relevance of the concept of climate debt for French and European economic policies. First, we define the concept and explore its possible uses. We then propose an assessment of the climate debt in France: it could amount to 61% of GDP in 2050. We conclude that climate debt is a simple and powerful way of integrating our decarbonisation objectives into our democratic decision-making processes. Moreover, by using the notion of debt, it emphasises the possible, but not necessary, trade-off between fiscal and climate sustainability.

1. What is climate debt?

Despite the legal commitments in international treaties and European legislation, our current policies and actions are insufficient to put us on a trajectory compatible with limiting global warming to 2°C. This accumulated delay in achieving our collective objectives of limiting global warming is what we call “climate debt”. In short, it is a “loan” of greenhouse gas emissions that we will have to “repay” in the future.

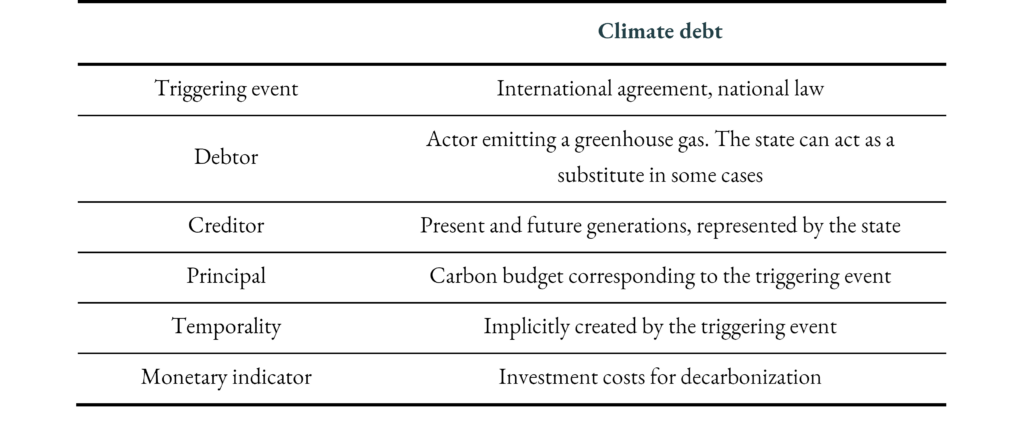

The concept of climate debt has a long history and multiple definitions. In general, speaking of a debt presupposes the existence of a contract or a law creating an obligation (here: the reduction of emissions) and implying a sacrifice of resources in the future (here: decarbonisation efforts). In our case, the origin or triggering event of climate debt can be found in international and European law. The use of European or international emission reduction commitments makes it possible to define a carbon budget for every country, and climate debt is directly linked to the exhaustion of this budget within the period defined by the international commitments.

Climate debt implies the presence of at least one debtor and one creditor, as well as the existence of a principal to be repaid within a certain period. In principle, any natural or legal person whose emissions fuel global warming is contributing to the accumulation of climate debt. However, there are different levels of responsibility, ranging from individuals and companies to the state. Given that the state is the only actor to have access to all the resources needed to “repay” the climate debt, it is responsible in practice. It is then up to the democratic process to split the bill among the various national economic players on the basis of their past actions and future capacity to act. Regarding the creditor, two conceptions coexist: climate debt as a debt to humanity or to nature. The latter concept recognises an intrinsic value in the natural world beyond human interests. However, although it is worth thinking about, nature does not necessarily have a legal representative to defend its interests. The situation is different if we consider current and future human generations as creditors of the debt. The state can act as their representative and bears legal responsibility for achieving the climate objectives. The possibility for citizens to sue the state for insufficient climate action illustrates this point.

What is the “principal” of the climate debt? The nature of the climate debt’s principal comes from the quasi-linear relationship between the increase in global temperature and cumulative greenhouse gas emissions. The emissions accumulated beyond the carbon budget defined by the triggering event of the debt therefore constitute the principal of the climate debt. The Intergovernmental Panel on Climate Change (IPCC) provides estimates of the global carbon budget remaining to limit warming to certain levels. However, this raises the complex question of how to distribute this budget by country. The commitments made at the EU level already allocate an annual carbon budget to each Member State, starting in 2021. In France, the National Low-Carbon Strategy (SNBC) details these budgets in 5-year periods and even includes sectoral allocations.

Climate debt can be seen as the cumulative deviation from an ideal trajectory of emission reduction. That said, several trajectories can be obtained from the same carbon budget, which affects the level of climate debt. Another important variable is the date at which we start to accumulate climate debt. This may be a historical date, the start of the industrial revolution for example, or a date corresponding to the triggering event of the debt, reflecting the moment when legal commitments were made (for example, 2019 for the European regulation on effort sharing).

Finally, why and how should climate debt be translated into monetary terms? Climate debt can include a monetary indicator for comparison purposes. Although it is essentially a biophysical debt in terms of excess emissions, climate debt can be translated into monetary terms via a cost of carbon. Such a cost can reflect several things:

- The economic and welfare damage caused by excess emissions (cost-benefit approach). However, there are substantial uncertainties in quantifying the damage caused by our inaction.

- A more operational approach is to use the carbon price corresponding to the implicit cost of mobilising the investments needed to achieve our decarbonisation objectives (cost-investment approach). Climate debt can then be understood as the cumulative investment need to achieve our climate objectives.

Expressing climate debt in monetary terms does not mean, however, that it is perfectly substitutable with financial debt. Nevertheless, assigning a monetary value is a useful translation exercise to compare climate debt with other economic indicators. Table 1 summarises the different choices we made to construct a definition of climate debt in this report.

Table 1 – Definition of climate debt used in this report

2. How to use climate debt?

Climate debt can enable climate issues to be included in political and economic decision-making. In exploring ways of operationalising it, we are following a philosophical tradition that seeks to establish a “politics of nature” in the sense of Bruno Latour.

Climate debt could play a promising and innovative role in the institutionalisation of climate policies:

- As an accounting tool, climate debt provides a concrete measure of the financial impact of past inaction and current efforts to mitigate climate change. Measured ex post, climate debt captures the accumulated costs due to delays or insufficient action to reduce greenhouse gas emissions, much like an accounting balance sheet. This approach not only reveals the financial consequences of past decisions, but also guides future policies by highlighting underperforming sectors. For example, since the implementation of the SNBC in 2015, it has been observed that France’s climate balance is negative, indicating insufficient progress in decarbonisation, particularly in the transport and industry sectors.

- As a planning and budgeting tool, climate debt allows for the comparison of the current emissions trajectory with an ideal trajectory and quantifies the additional efforts required to align with it. This can enhance the assessment of investment needs for the transition. It may therefore have a place in the government’s annual budget publications. According to Article 9 of the LPFP [1] 2024, the government will now have to specify its multiannual strategy for financing the transition and put it up for debate each year. In the context of this report, it could be interesting to know how the proposed new measures contribute to the reduction of the climate debt. More broadly, climate debt could serve as the basis for an debt isolation strategy similar to that of the Caisse d’Amortissement de la Dette Sociale (CADES) [2].

However, not all applications of climate debt are equally valuable. It should be noted that when quantified solely in terms of emissions, climate debt may seem too ambiguous or provide little information compared to existing indicators. Moreover, quantifying climate debt in terms of damages currently lacks the precision needed to support legal claims for compensation related to our insufficient climate action.

3. How to measure climate debt?

In this report, we propose measuring climate debt as investment debt. To measure climate debt, two elements are needed: an ideal decarbonisation trajectory that specifies a carbon budget for each year, and a time series of CO2 emissions. In addition, a financial valuation of carbon emissions is needed to quantify the deviation from this ideal scenario in monetary terms.

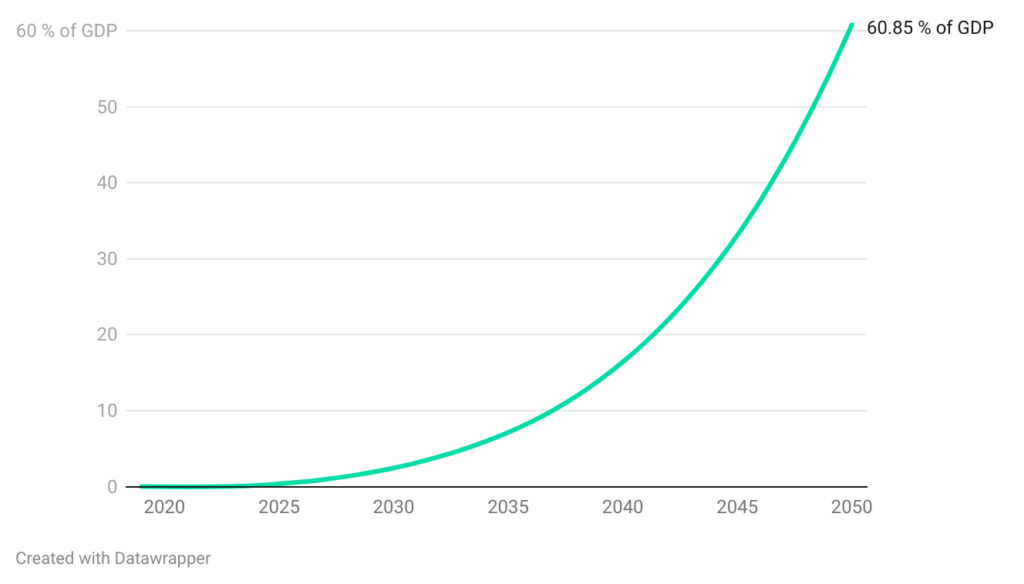

Taking 2019 as the starting point, France’s climate debt is estimated at 61% of GDP in 2050, which corresponds to €26,000 per capita in constant prices. Graph 1 shows that in the absence of additional measures, the total value of the decarbonisation investment gap will have reached 61% of GDP by 2050. The climate debt grows exponentially over the period, reaching 2.4% of GDP in 2030 and 16.4% in 2040.

Graph 1 – Climate debt by 2050 (% of GDP)

Note: In 2050, climate debt is expected to amount to 60.85% of France’s real GDP.

Source : Authors’ calculation.

Our baseline estimate builds on the ideal emissions trajectory defined by the SNBC 2. The CO2 emissions forecast up to 2050 is taken from the “With Existing Measures 2023” scenario of the French Directorate General for Energy and Climate (DGEC). We use the carbon price defined in the Quinet report, which is €250 per tonne of CO2 equivalent in 2030 and rises to €775 in 2050 (in 2018 prices). The socio-economic discount rate of 4.5% is also taken from this report. The start date of the debt in 2019 corresponds to the moment when the EU’s legal commitments became binding, and we have chosen to stop in 2050, as we consider by convention that beyond this date, part of the climate debt will be unavoidable (and, in a way, forcibly repaid). Our parameter choices for this baseline estimate reflect the scientific consensus, but we also test the sensitivity of our measure to various parameter choices, including emission reduction scenarios from the Network for Greening the Financial System, IPCC carbon budgets, and different carbon price series. Modelling the evolution of carbon sinks differently, for example, could lead to an increase in climate debt to 85% of GDP by 2050.

4. Recommendations of the report

Using climate debt as an indicator encourages us to consider the long term and in particular the impact of our actions on global warming. This report puts forward a number of recommendations for its use in practice:

Recommendation 1: Better account for the trade-offs that may exist between financial debt and climate debt.

Comparing climate and financial debt is not necessarily possible. Climate debt is above all a biophysical debt and the choice of associating it with a monetary indicator is a social convention. This convention can be informed by economic models that treat climate debt as an investment debt to achieve carbon neutrality. Converting it into a monetary unit, however, invites us to consider both financial and climate debt together. Favouring the reduction of financial debt in the short term may be beneficial in terms of fiscal sustainability, but detrimental in terms of environmental sustainability, as shown by the comparison of the NGFS – Net Zero and NGFS – Delayed Transition scenarios.

Recommendation 2: Include climate debt among the indicators measured by the DGEC in its scenarios.

A measure of climate debt in terms of investment gap in 2030, 2040 and 2050 should accompany the publication of the “With Existing Measures” scenarios by the Directorate General for Energy and Climate. DGEC forecasters would be responsible for its calculation and parameter selection. The climate debt measure should be updated when a new version of the SNBC is published.

Recommendation 3: Integrate the climate debt measure calculated by the DGEC in the multiannual financing strategy submitted to Parliament and provided for in the LPFP 2024.

Article 9 of the LPFP 2024 requires the government to present a multi-year strategy to the Parliament, outlining the financing of the green transition and national energy policy. This strategy should include the DGEC’s climate debt measure to facilitate its adoption by parliamentarians. Additionally, the indicator should be published and discussed on a regular basis to permeate democratic debate. The publication of climate debt indicators could also be integrated into the report required by the law aimed at taking into account new wealth indicators in the definition of public policies, enacted on 14 April 2015, which mandates the government to regularly present the development of new wealth indicators, such as inequality, quality of life, and sustainable development indicators to Parliament.

Recommendation 4: Continue the work on environmental accounting initiated by INSEE within the framework of enhanced accounts and increase resources allocated to it.

This could start with the development of carbon and environmental accounting in municipalities and businesses to provide reliable and detailed estimates of individual climate debts. Article 191 of the Finance Law for 2024 requires municipalities to append from now on a “green budget” to their budget documents. Currently confined to labelling “green” or “brown” expenditures, this could eventually be strengthened by a measure of ecological and climate debt.

Recommendation 5: Explore ways of integrating climate debt into the economic decision-making process.

The widespread use of climate debt and environmental accounting calls for the creation of new models and processes to institutionalise environmental considerations in economic decision-making, such as the creation of a climate debt isolation fund. In particular, climate debt can be linked to other indicators used to approach and monitor a certain vision of well-being. We invite researchers and qualified individuals to take hold of this concept and explore its possible uses.

Recommendation 6: Advocate for calculating climate debt at the European level and integrating it into the indicators calculated by Eurostat.

Calculating the climate debt of the EU Member States would make it easier to clarify their respective responsibilities in the context of the green transition and would be superior to the reduction targets defined to date by country. This calculation makes sense, as emission reduction trajectories are defined at the European level. It would also have the advantage of helping to resolve several ongoing European debates, particularly regarding the emissions reduction trajectory and the distribution of efforts. Finally, climate debt can enrich the work of the EU and the United Nations (SEEA) on environmental accounting, by complementing emission accounts (and more broadly biophysical accounts) with monetary indicators, which are still missing.

Lead authors : Cyprien Batut, Jonas Kaiser, Clément Surun

Other members of the working group : Louis Daumas, Thomas Kekenbosch, Clara Leonard, Paul Malliet, Aude Pommeret

Image: Gustav Kimt, Der Park, 1910, oil on canvas, 110.4 x 110.4 cm.

Notes

[1] The LPFP (loi de programmation des finances publiques) outlines France’s multi-year strategy and objectives for public finance management, including fiscal policies and targets.

[2] CADES is an administrative state agency established in 1996 to redeem French social debt. Its mission is to fund and redeem the debt of the Social Security. For more details see: Leonard, C. (2024), Une Caisse d’amortissement pour renforcer la soutenabilité climatique, Institut Avant-garde, February.